What Is Counterparty In Finance . counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. Any trade must have at least two. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk is the likelihood or probability that one of those involved in a transaction might default on. a counterparty in a financial transaction is the person or entity on the other side of the agreement.

from www.slideserve.com

Any trade must have at least two. counterparty risk is the likelihood or probability that one of those involved in a transaction might default on. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. a counterparty in a financial transaction is the person or entity on the other side of the agreement. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. a counterparty is the other party in a financial transaction, essential in all types of deals.

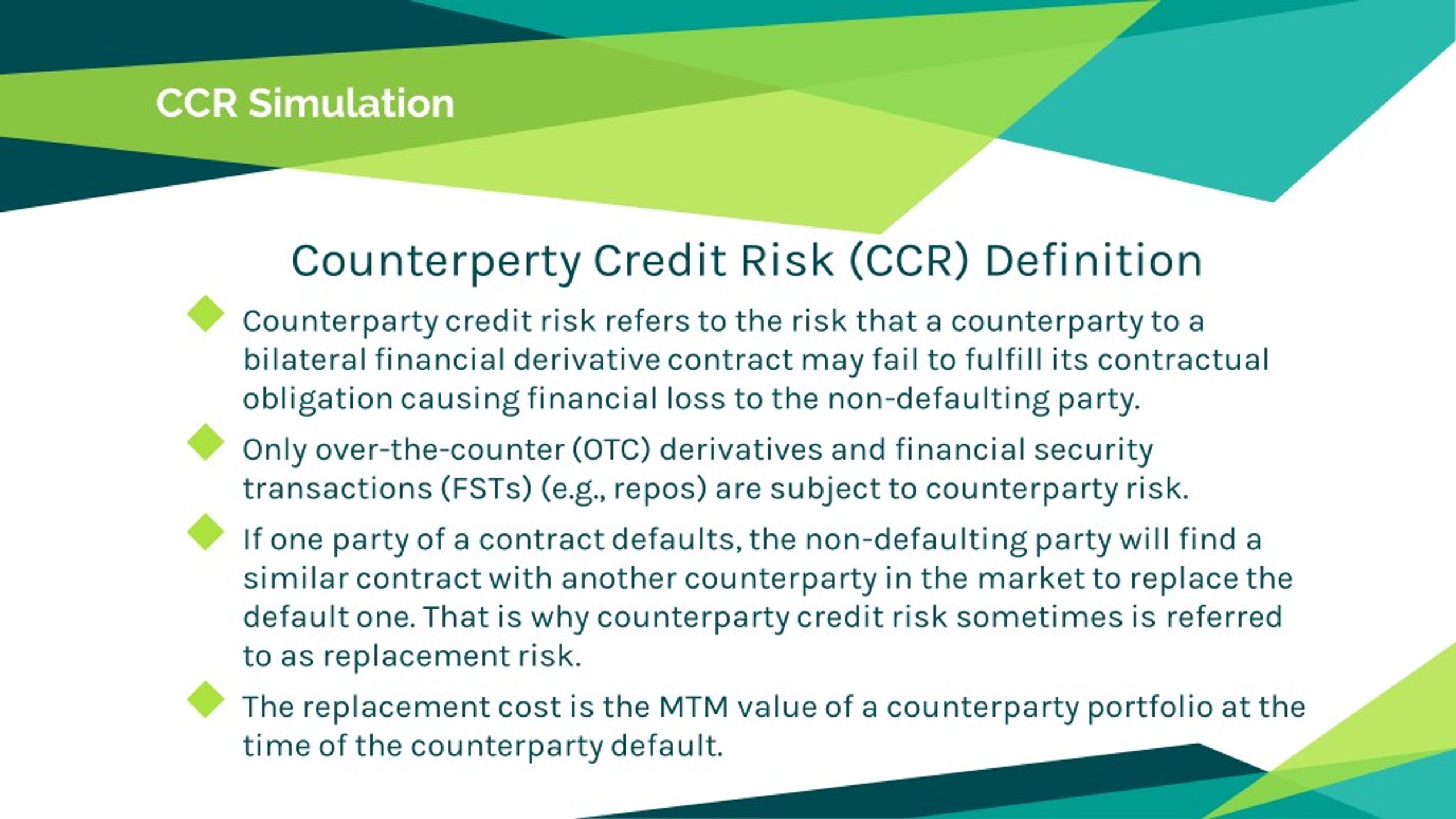

PPT Introduction to Counterparty Credit Risk Simulation PowerPoint

What Is Counterparty In Finance Any trade must have at least two. a counterparty in a financial transaction is the person or entity on the other side of the agreement. Any trade must have at least two. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. a counterparty is the other party in a financial transaction, essential in all types of deals. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk is the likelihood or probability that one of those involved in a transaction might default on. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual.

From tiblio.com

Counterparty Risk Finance Explained What Is Counterparty In Finance a counterparty in a financial transaction is the person or entity on the other side of the agreement. a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. counterparty risk is. What Is Counterparty In Finance.

From coincentral.com

What is Counterparty (XCP)? Beginner's Guide CoinCentral What Is Counterparty In Finance a counterparty in a financial transaction is the person or entity on the other side of the agreement. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk, also. What Is Counterparty In Finance.

From www.financestrategists.com

Counterparty Risk Definition, Types, Applications, Management What Is Counterparty In Finance Any trade must have at least two. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. counterparty risk is the likelihood or probability that one of those involved in a transaction might default on. counterparty risk is the risk associated with the other party to a financial. What Is Counterparty In Finance.

From azcoinnews.com

What is Counterparty (XCP)? What Is Counterparty In Finance counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. a counterparty in a financial transaction is the person or entity on the other side of the agreement. a counterparty is the other party in a financial transaction, essential in all types of deals. . What Is Counterparty In Finance.

From analystprep.com

Counterparty Risk Intermediation FRM Part 2 Study Notes AnalystPrep What Is Counterparty In Finance counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. a counterparty in a financial transaction is the person or entity on the other side of the. What Is Counterparty In Finance.

From nas100scalping.com

What is a Counterparty? Unraveling Its Role in Financial Transactions What Is Counterparty In Finance counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual.. What Is Counterparty In Finance.

From www.gfmi.com

Understanding Central Counterparties (CCPs) Global Financial Markets What Is Counterparty In Finance a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a. a counterparty in a financial transaction is the person or entity on the other side of the agreement. Any trade. What Is Counterparty In Finance.

From www.eachccp.eu

About clearing EACH European Association of CCP Clearing Houses What Is Counterparty In Finance a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction, typically a.. What Is Counterparty In Finance.

From coinswitch.co

What is Counterparty? 2019 Beginner's Guide on XCP Cryptocurrency What Is Counterparty In Finance counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk is the likelihood or probability that one of those involved in a transaction might default on. counterparty risk, often referred to as default risk, measures the probability that a participant in a transaction,. What Is Counterparty In Finance.

From www.slideserve.com

PPT Introduction to Counterparty Credit Risk Simulation PowerPoint What Is Counterparty In Finance a counterparty in a financial transaction is the person or entity on the other side of the agreement. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. Any trade must have at least two. counterparty risk is the risk associated with the other party. What Is Counterparty In Finance.

From fxbrokerreviews.org

What Is Counterparty Risk? {Definition & Examples} What Is Counterparty In Finance counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. a counterparty in a financial transaction is the person or entity on the other side of the agreement. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an. What Is Counterparty In Finance.

From www.financestrategists.com

Counterparty Risk Definition, Types, Applications, Management What Is Counterparty In Finance a counterparty is the other party in a financial transaction, essential in all types of deals. Any trade must have at least two. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk is the risk associated with the other party to a financial contract not meeting. What Is Counterparty In Finance.

From www.scribd.com

Counterparty Credit Risk Overview PDF Over The Counter (Finance What Is Counterparty In Finance a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their. What Is Counterparty In Finance.

From www.investopedia.com

Central Counterparty Clearing House—CCP Definition What Is Counterparty In Finance a counterparty is the other party in a financial transaction, essential in all types of deals. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. . What Is Counterparty In Finance.

From adrtimes.com

What Is a Counterparty? Understanding the Basics ADR Times What Is Counterparty In Finance a counterparty in a financial transaction is the person or entity on the other side of the agreement. Any trade must have at least two. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. counterparty risk is the likelihood or probability that one of. What Is Counterparty In Finance.

From margcompusoft.com

Understanding Central Counterparties (CCPs) and Their Role in Financial What Is Counterparty In Finance Any trade must have at least two. a counterparty (sometimes contraparty) is a legal entity, unincorporated entity, or collection of entities to which an exposure. counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. counterparty risk, also known as default risk, is a financial risk inherent in contracts. What Is Counterparty In Finance.

From www.slideserve.com

PPT Central Counterparty institution and its role in financial What Is Counterparty In Finance Any trade must have at least two. a counterparty is the other party in a financial transaction, essential in all types of deals. a counterparty in a financial transaction is the person or entity on the other side of the agreement. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a. What Is Counterparty In Finance.

From financestu.com

Credit Risk vs. Counterparty Risk Is There Any Difference? What Is Counterparty In Finance a counterparty is the other party in a financial transaction, essential in all types of deals. a counterparty in a financial transaction is the person or entity on the other side of the agreement. counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual. . What Is Counterparty In Finance.